Bookies Close Winning Accounts

- Bookies Close Winning Accounts Meaning

- Do Bookies Close Winning Accounts

- Do Bookmakers Close Winning Accounts

The principle of value betting is not to bet when you think you will win, but when the probability of you winning is greater than that implied by the bookmaker’s odds. To be a profitable bettor means that your judgement is better than your bookmaker’s. In this article, Joseph Buchdahl explains how sportsbooks manage the odds and shows how beating the bookies works. Read on to find out.

In 2014 Pinnacle tested the Wisdom of the Crowd hypothesis by inviting people to guess the number of chocolate balls in a video. By the end of the test, the average guess was just 1.4% higher than the actual figure, despite only 1 person out of the 608 entries guessing correctly.

Beating bookies in betting sounds awkward, but it is possible through properly calculated maths. The basics you need to understand first are the pricing the bookmakers make, the wisdom of the crowd principle, and does the bookie close winning accounts. As soon as they see you are 100% structured, measured, and are not going to be a losing punter long term, they will eventually cotton on to you and close your account. The longer you can hold them off from restricting or closing your account, the better!

[Although] the results of sporting events cannot be known a priori, yet even under these conditions the crowd does generally provide an accurate assessment of the respective probabilities of the outcomes.

Of course, sporting outcomes are binary by nature: they either happen or they don’t. However, it is the flow of money via which the opinions of bettors are expressed that is used by bookmakers to judge the respective outcome probabilities, by means of the odds. It is true that herds are prone to expressing systematic biased judgement when faced with uncertainty, leading to a collectively less wise opinion.

However, typically we find that the more liquid (or popular) the betting market, the better the collective wisdom. The greater the number of independently acting players expressing a range of diverse views about a sporting event there are, the more likely it is that a crowd will be wise and the betting odds accurate.

The wisdom of Pinnacle bettors

I have previously examined just how accurate Pinnacle’s 1X2 soccer match betting odds are, and by extension how wise their market is, by means of comparing expected outcome probabilities (defined by the odds) to actual outcome percentages. This analysis demonstrated that Pinnacle’s betting odds, on average, are highly efficient - that is to say, accurate.

The greater the number of independently acting players expressing a range of diverse views about a sporting event there are, the more likely it is that a crowd will be wise and the betting odds accurate.

For example, teams fairly priced at 2.00 (i.e. once Pinnacle’s margin has been removed) typically win about 50% of the time. Teams priced at 4.00 win 25% of the time, and so on. Whilst such an observation is not conclusive proof of market efficiency, it is consistent with it.

Of course, not all bookmakers offer the same price for a team. For example, Pinnacle offered a price of 2.22 for Liverpool to beat Tottenham in their game played 11th February 2017. This varied between 2.15 and 2.33 with other bookmakers. How do we know which price was more accurate?

Testing Pinnacle’s wisdom against other bookmakers

One way we could test relative price efficiency of Pinnacle versus other bookmakers is to formulate the following hypothesis and accompanying test:

1)Assume Pinnacle’s odds (with their margin removed) provide an exact measure of the true outcome probabilities.

2)Consequently, the ratio of another bookmaker’s odds to Pinnacle’s odds provides a measure of expected value or expected return.

3)Analyse actual returns across a range of expected values.

For example, with the margin removed, Pinnacle’s estimated fair price for Liverpool to beat Tottenham was about 2.25, implying roughly a 44% outcome probability. Consequently, if our hypothesis is correct, the best market price of 2.33 would offer an expected return of about 1.035 or profit of +3.5% (2.33/2.25).

On the other hand, betting at the market low of 2.15 would entail an expected return of 0.956 or loss of -4.4% (2.15/2.25). If we then find that all bets with an expected profit of +3.5% (or loss of -4.4%) collectively return a profit of 3.5% (or loss of 4.4%), we would conclude that our hypothesis is correct, that is to say Pinnacle’s odds, on average, are efficient, accurate or wise.

So, how wise is Pinnacle’s soccer match betting markets? I’ve analysed a sample of 35,570 league matches played throughout Europe since the start of the 2012/13 season, yielding 106,710 possible outcomes from the home/draw/away market.

For each, the expected value (or return) is calculated by the ratio of the odds from one of four leading bookmakers to that of Pinnacle’s price with their margin removed, yielding 426,840 expected returns. Actual returns are then calculated for 0.01 intervals in expected return (for example 0.98, 0.99, 1.00, 1.01 etc) before a 5-point running average is used to smooth the variance in the data. Data is plotted in a scatter graph below, with very low and very high-expected returns removed for which there are understandably far fewer contributing data points.

The correlation between expected and observed returns is very strong and essentially 1:1. That is to say, when the expected return over a sample of matches is 90%, we actually return about 90% (or a loss of 10%). When the expected return is 105%, we actually return about 105% (or a profit of 5%)

Market folly or manipulation

Let’s now reverse the process. This time, let’s assume that our other bookmakers’ odds (with their margins removed) provide an accurate measure of true outcome probabilities. How do actual returns, this time betting Pinnacle’s odds, compare to those expected by the hypothesis? Take a look.

Now, correlation between expected and actual returns is completely absent. If a fair price is 2.00, whether Pinnacle offers 1.8 or 2.1 makes no difference: we lose about 2% regardless (which is roughly the size of Pinnacle’s soccer match betting market margin). The implication is that the odds from the four other bookmakers used in this analysis do not, on average, provide any meaningful measure of the true outcome probabilities relative to Pinnacle’s. It’s Pinnacle’s price, which provides the accurate measure.

Bookies Close Winning Accounts Meaning

What pricing model does your bookmaker use?

Presumably, there are two possible explanations for such a finding. Perhaps other bookmakers don’t know how to set prices properly. Evidently, that is not a credible conclusion, given the longevity of success of these bookmakers. Alternatively, we could speculate that bookmakers are intentionally shifting prices away from market efficiency in favour of pursuing interests of their business models.

Pinnacle’s pricing model utilises crowd wisdom and accepts sharp players to tighten them. Other bookmakers from Europe and the UK prefer to encourage a steady flow of squares via promotional offers, a wider variety of low-liquidity markets and the regular availability of best market prices (if not the lowest margins). With respect to the last of those, a casual perusal of any odds comparison will reveal numerous matches where bookmakers are significantly out of line with Pinnacle’s market, and in the extreme offer loss-leading value to the player.

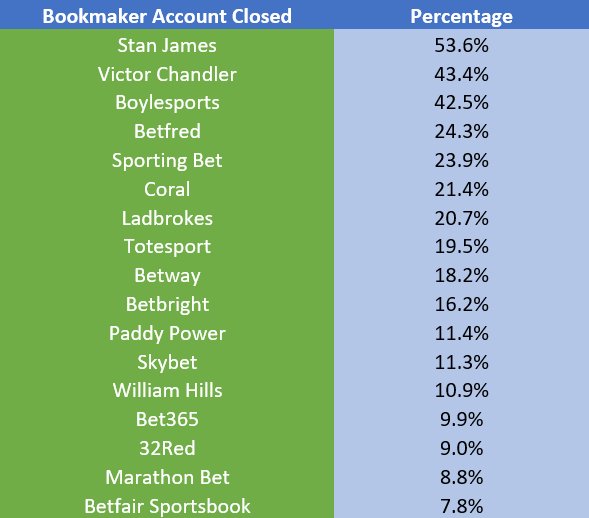

In my analysis sample, such positive expectation was available in 4.1% of the betting propositions. Naturally, this would account for why so many of these alternative brands, in contrast to Pinnacle, rely on account closures to mitigate the threat of players taking systematic advantage of these loss-leading prices either through value betting or arbitrage. It will also come as no surprise to learn that whilst Pinnacle openly accepts arbitrage players, other brands do not, and that typically the bookmaker on the negative expectation side of the arbitrage, from the perspective of the punter, is Pinnacle.

This is not to say Pinnacle’s betting market is perfectly efficient; just that inefficiencies are harder to find and exploit. However, those sharp enough to find them can do so safe in the knowledge that their custom will always be welcome. It helps, indeed, to build the wise betting market that sets Pinnacle apart from its competitors.

With more and more cases of winning bettors complaining about having their accounts closed or severely restricted by leading bookmakers, what are the reasons behind this off-the-record practice? Read on to find out what can get your betting account closed and why this will never happen to you at Pinnacle.

In the past two decades, the spread of the Internet changed the gambling industry landscape for good, making online betting the most popular way for placing wagers.

With an increasing number of sites making historical data and statistics available to the public, more and more well-educated people turned to sports betting not only as a means of entertainment, but also as a means of living.

Main indicators that flag an account and can lead to closure or severe restrictions are: bet size, free bets and bonuses, user behavior and profitability.

Professional bettors have a strong understanding of the mathematics of bookmaking and manage to make long-term profits by applying arbitrage strategies and bet hedging.

Despite claims to the contrary, a common off-the-record practice among mainstream bookmakers in an attempt to exclude winning players from their business, is to close or severely limit winning accounts.

While some bookmakers go as far as cancelling accounts and literally barring profitable bettors from their e-premises, others effectively end their relationship by limiting the stakes to ridiculously small amounts such as $2 per bet.

Criteria for limiting/closing accounts

With more and more bookmakers looking to attract square punters (those who bet more than they win on a daily basis), professional bettors are the anathema to leading sportsbooks. But how do bookmakers know who bets for a living?

Below are the main indicators that flag an account as professional and can lead to closure or severe restrictions of betting amounts:

- Bet size: Professional bettors do not experiment with their money. They often calculate the exact amount of money they need to place on a market in order to ensure winnings. Odd stake amounts such as $79.34, for example, indicate arbitrage, which is a common strategy among professional bettors.

- Free bets & bonuses: Professional bettors are rarely interested in specials offers. They will only take them if they fit into their business plan, which is rarely the case as free bets and bonuses come with a long list of terms & conditions.

- User behavior: Professional bettors don’t bet for fun, they bet for a living. You will rarely find them hanging around the website watching live matches. They login, place their bets and move on to the next bookmaker.

- Profitability: Last but not least, professional bettors take more money out of a bookmaker than they put in.

Surprisingly enough, profitability is not the first factor a bookmaker looks at. In order to know who is profitable in the long run, you have to let time pass and then it might be too late.

Refusing to accept a bet at the advertised odds may break the spirit of fair game, but it does not break any law.

What bookmakers try to do is detect professional bettors before they manage to take money out their pockets. For that reason, they develop guidelines for risk groups and profiles on players based on their behaviors and betting patterns.

This rigid style of investigation can catch out bettors who are not professionals but to eliminate risk, bookmakers take the better-safe-than-sorry approach. This means that in many cases, casual bettors can have their accounts shut down or heavily curtailed for no apparent reason or any further explanation other than:

We are writing to you to inform you that a business decision has been taken by our senior traders and your betting account has now been closed. No further business may be executed on your behalf. As explained in our Terms and Conditions, a trader's decision is final and will not be overturned.

Is closing betting accounts illegal?

Refusing to accept a bet at the advertised odds may break the spirit of fair game, but it does not break any law.

There are several organisations that are involved in the regulation of the gambling sector, however their primary role is to adjudicate on bets that have been placed, not arbitrary account closures or betting limitations.

Until the industry’s regulations change, so that a bookmaker’s unfounded refusal to accept bets is a reason to lose their licence, it is down to the individual to choose who they entrust their money with.

Why Pinnacle allows winning accounts

Bookmakers must manage their risk to stay in business. For that reason bookmakers set limits on how much money they are willing to accept on each market. However, managing risk is one thing and playing unfair quite another.

Until the industry’s regulations change, so that a bookmaker’s unfounded refusal to accept bets is a reason to lose their licence, it is down to the individual to choose a reliable bookmaker.

At Pinnacle, we don't just believe that it is important to treat bettors fairly. We are on a mission to educate players on how bookmaking works, so that they can choose smart when deciding what is the best sports betting deal online.

As opposed to the practices of mainstream bookmakers, Pinnacle is known for offering zero bonuses. Instead of throwing our money into expensive marketing campaigns, we invest it in risk management.

Do Bookies Close Winning Accounts

Our unique model not only allows us to guarantee you an account no matter how much you win, but it also enables us to offer the highest odds in the online betting industry. When mainstream bookmakers offer rounded odds of 2.00, 3.40 or 1.70, don't be surprised to see Pinnacle offering odds as precise as 2.23, 3.826 or 1.92. To find out more about how Pinnacle can do that, read The maths behind Pinnacle’s winners welcome policy.

Do Bookmakers Close Winning Accounts

But don't take our word for it. We encourage you to compare us to other bookmakers, before you decide for yourself which sportsbook offers the best deal. That’s why Pinnacle is the number one choice of winning bettors.